An Introduction to

Options Trading for Beginners

Keep reading and explore this guide to options trading for beginners.

Getting started with options trading can be overwhelming and confusing. Trading before you even understand its ins and outs will lead you to losses and frustration. This is why you need to learn the basics of options trading first and understand its complexities before you even think of searching for the best options trading platforms for beginners and opening an account with one of them.

Beginners in options trading can start with this introduction before you pursue learning further on other platforms. This can serve as the groundwork for your options trading education and the profits that you will enjoy in the future.

What are Options

Each option contract states the following

Underlying asset

This is the asset to be exchanged when the option is exercised.

Type

This refers to what type of option is agreed upon. There are two basic types - call and put.

Premium

This is what you pay for an option contract.

Strike Price

This refers to the predetermined price at which the underlying asset can be purchased or sold. The strike price is sometimes referred to as the exercise price.

Spot price

This is the market price at which the underlying asset can be bought or sold.

Expiration date

This is the last day that the option holder can exercise their right to purchase the underlying asset at the specified terms.

Exercise style

This refers to when the options contract can be exercised - European or American. European exercise style means the option can only be exercised on the expiry date while American exercise style means it can be exercised on or before the expiration date.

Contract size

This is the amount of underlying assets represented by the option contract.

Settlement style

This refers to how the underlying assets change ownership when the option is exercised. There are two ways an option contract can be settled - physical and cash. Physical settlement involves delivery of the underlying assets while cash settlement involves a cash transfer of the price difference between the strike price and the current value of the asset.

Two Basic Types of Options

Call options

A call option is a contract giving the holder the right to buy an asset at the specified strike price. Call options are bought when you believe the price of the underlying asset will increase in the future - on or before its expiry date.

Put options

A put option gives the holder the right to sell the asset at the specified strike price in the contract. The option writer is obligated to purchase the asset if the option holder chooses to exercise their right to sell it. Put options are bought when you believe the price of the asset will decrease on or before the expiry date.

Options trading

How Options Trading Works

Options trading is the practice of buying or selling these contracts. Options holders (the buyer) purchase these contracts from the writer who creates them for a premium, which is only a fraction of the cost per share of the security. This allows the holder to profit at a higher percentage when they exercise the options and sell the securities in the market. In most cases, the premium is the maximum a holder can lose if they do not exercise it and let it expire.

When trading options, you are essentially placing a bet on where the direction a market will go for a security in question and when these changes in its current value will occur. But, unlike equities trading, you are not buying a share of a company, index, or fund. Instead, you are buying the contracts for a premium, which amounts to a fraction of the value of the security in question.

Since trading options involve “betting” on how the market prices will go for an asset, you can categorize your actions based on your market outlook. Here are the different option trades that you can make based on how you think the market will go.

Trading Options with a

Bullish Outlook

A long call option refers to when you buy a call option in anticipation of the underlying asset’s increase in value. This allows you to buy an asset at a lower price than its market value if you plan it right, which earns you more profits when you sell the asset immediately at the spot price. On the other hand, if you choose not to exercise the right to buy, your losses are only the premiums paid for the long call option.

To illustrate this, let’s say you purchased a long call option for 100 shares of stock ABC for $1 worth of premium. The option contract has a strike price of $20 and expires 7 days after the issuance.

If you exercise your option when the spot price is at $25, this means that you get a payoff of $5 per share ($25 spot price – $20 strike price) and a profit of $4 per share ($5 payoff – $1 premium paid per share). This gives you a total profit of $400 for the trade ($4 profit per share x 100 shares).

On the other hand, if you do not choose to exercise the option, your losses are limited to the premium you have paid, which is $100.

A short put option is done when you open a position by selling a put. This position is taken when you believe the price of the asset will stay above the strike price of the put option. When the option expires with the spot price above the strike price, it expires worthless and you take the premium per share as your profit. On the other hand, if the market price falls below the strike price and the option holder exercises their right to make the purchase, you will face a loss.

Unlike standard call and put options, you are not the holder of the option in this position but, instead, you are its writer. This gives you the obligation to buy the underlying asset at the predetermined strike price in the contract on or before the specified expiration date. You take this obligation in exchange for the premium paid by the option holder.

Trading Options with a

Bearish Outlook

A long put option is when you buy a put option with the anticipation that its underlying asset will decline. Having a long-put position gives you the right to sell the asset at the strike price on or before the expiry date.

You can take advantage of the strike price by exercising your right to sell the asset when the spot price is lower, earning you more profits from the trade. Your losses are limited to the premium paid for the option if the asset’s value increases and you do not choose to exercise your right to sell it.

For example, you bought a put option worth $1 premium per share for a stock at a strike price of $50. If you exercise the option when the market price falls to $30 and sell it immediately, you have earned a payoff of $20 per share ($50 strike price – $30 spot price) in the trade, giving you a profit of $19 per share ($20 payoff – $1 premium).

A short call option is a position that you take when you believe the asset’s price will fall below the strike price in the future. If your strategy is a success, you profit from the premium paid by the buyer for the option. Alternatively, if the market price goes up and above the strike price and the holder exercises their option, you will take on a loss equivalent to your premium minus the difference between the strike price and the market price.

Similar to a short-put option, you are not the option holder in this position. You are the writer and, therefore, take on the risk of delivering the asset when the option holder (the buyer) decides to exercise their option. You take this risk in exchange for the premium you get that the buyer pays for the option.

The Advantages of Options Trading

Options trading allows you to take on a position similar to a stock, index, or fund’s position at a fraction of the required investment. To illustrate, purchasing 100 shares of a $100 stock requires a total payout of $10,000. However, purchasing a $25 call option for 100 shares of the same stock requires only $2,500.

With the smaller payout requirement, options trading allows you to take on the same position and enjoy similar returns with a smaller capital. And, the savings you get from investing in options allows you to have more funds to invest in other assets.

Options can be riskier than investing or trading equities. But, when used properly, you can use options to reduce the overall risk of your portfolio.

For example, you can use long put options to hedge against massive losses from your investment in equities. Let’s say you have invested in a stock that you believe will appreciate in the near future. You can purchase a put option for the same stock to, at least, limit your losses from your equities investment when the market price goes below the strike price. And, with potential losses in your put position limited to the premium, you can recoup it from the profit of your equities trade when the stock appreciates to your target price.

Trading options allow you to put in less money and make almost the same profits as trading the underlying asset directly. This gives you higher potential returns when trading options than buying the asset and selling it later on.

For example, a stock currently worth $100 in the market is projected to increase by $10 in the future. If you purchased the stocks, your investment nets a 10 percent return. On the other hand, if you purchased call options for the same stock at $12 worth of premium per share and you get $8 profit for each one, your investment gets a 67% return.

The Risks of Options Trading

When trading options, the premium you pay for the option contracts is your capital for each trade. You will lose the premiums you paid if you choose not to exercise your right to buy or sell the underlying asset stated in the contract. If you are not careful and if you are not hedging against possible losses, you are placing your trading capital at risk of significant losses.

Moreover, placing positions wherein you are the option writer puts you at risk of losing large amounts of money. This is due to the theoretically unlimited loss potential from shorting call and put options.

How to Manage the

Risks of Options Trading

Learn Before Starting

Take Your Profit As Planned

Set and Stick to Your Loss Cap

Cover Your Calls

How Our Options Trading

Alerts Can Help Beginners

Timing is everything in the financial markets. And, as you have learned above, options trading is not any different. Every moment is important and any delay in market analyses and trade executions may lead to you missing profitable opportunities and executing bad trades. Moreover, if you have daily or weekly time horizons, you have a smaller margin for error in making well-informed decisions at the right moment.

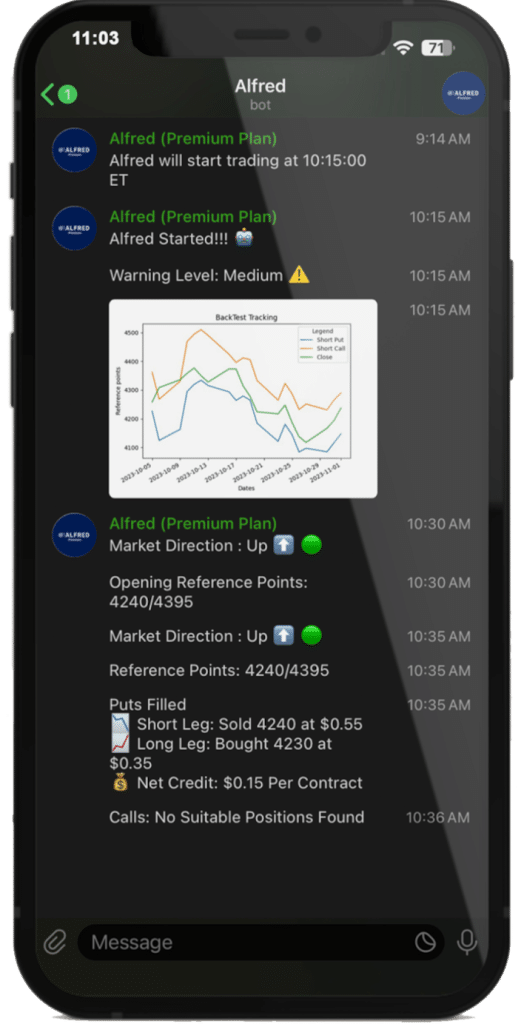

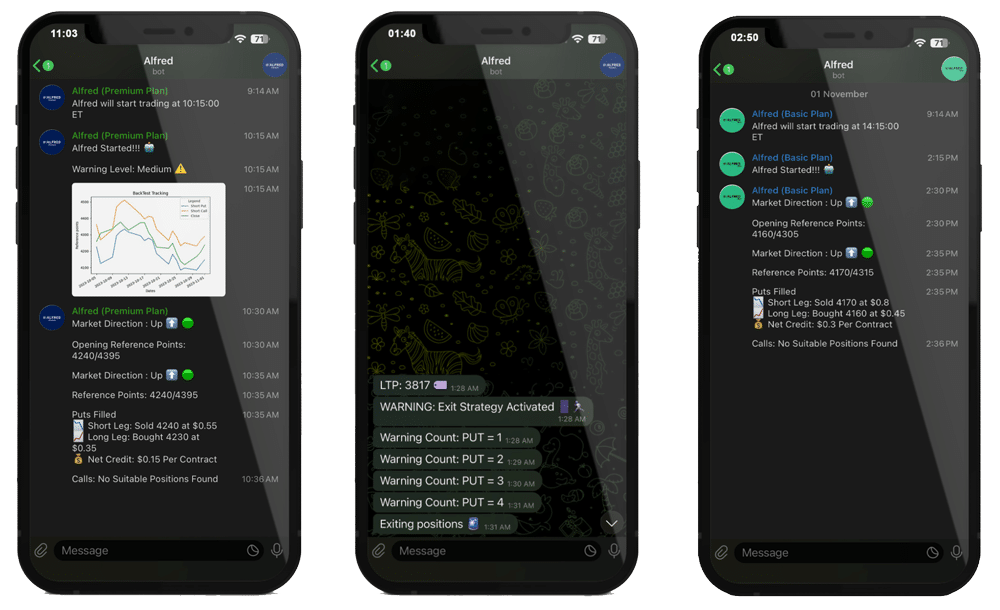

This makes All American Group’s algorithm-based options trading alerts an indispensable tool for options traders. Traders, especially beginners, can have an easier time planning their trades and responding to changes in the market. This is thanks to the timely notifications our algorithm sends out – alerting users about the market direction for the day, initial reference points for puts and calls, warning levels based on market volatility, and exit strategies as a response to changes in the market.

With our options trading alerts, you gain a competitive edge in the world of options trading. You are always in the know, so you can capitalize on the latest emerging opportunities and react swiftly to market shifts. With All American Group, you can make your trading decisions with confidence since our algorithms have analyzed the market conditions and provided the best course of action to profit or manage your risk.

Try Out Our Algorithm-Based

Options Trading Alerts for Beginners

Seize this chance to improve the consistency and winning rate of your option trades with our algorithm-based options trading alerts! Sign up today to start your free trial and experience the different data-driven trading offers to your portfolio and peace of mind. Click on the link below to learn more about the best options trading alert service designed for beginners!

Frequently Asked Questions

All American Group’s algorithm-based trading strategy utilizes put and call vertical spreads to capitalize on range estimates of the S&P 500 Index (SPX). Our trading algorithm, Alfred, uses complex formulas and mathematical modeling to analyze the current market, determine the market direction and reference points, and decide if there are any trades worth making.

If there are potentially profitable trades, Alfred will execute the trade, with a strike point at the lower end of the estimated closing range for SPX. Alfred may decide to enter a put and call vertical spread depending on market conditions and volatility. If it sees there is too much risk and there are no viable positions for the day, it will not put in a position.

Our algorithm-based trading strategy is available through the subscription plan All American Group offers to its customers. We offer two plans – Alfred Basic and Alfred Premium. The Alfred Basic subscription plan is available at $399 per month and offers the following features:

- Open reference points

- Entry reference points

- Trade execution

As for Alfred Premium, it is available at $479 per month and offers everything that the Alfred Basic has and the following premium features:

- Morning warning chart

- Warning strategy

- Exit strategy

Trade with Confidence and Consistency with the

Best Options Trading Alert Service

As a novice trader, it is not only important to make decisions grounded in sound analysis and planning. It is also essential to adjust your strategy to the changing conditions of the market and emerging news about the economy and the industries involved. With All American Group’s algorithm-based alerts, options trading beginners can trade with confidence and consistency and start their financial journey in their chosen options trading platform with ease.

Don’t miss out on this chance to revolutionize your options trading journey. Start your 14-day free trial and experience the difference our algorithm-based options trading alerts can bring.