How It Works

How To Trade Alfred

Meet Alfred, an experienced options algorithm which utilizes both put and call vertical spreads to capitalize on range estimates of the S&P 500 Index (SPX). Savvy traders utilize these strategies to manage risk and potentially profit in financial markets. In this tutorial, we’ll explore what selling a put vertical spread and a call vertical spread entail, how they work, and the ways they can either succeed or fail.

Alfred attempts to trade every trading day, however, depending on market conditions, Alfred may decide a trade is not worth the risk and sit out that day. It’s better to be cautious and live to trade another day! On days when you decide to enter a trade, it is strongly suggested to have the ability to monitor the trade throughout the day. Markets move fast these days, and you don’t want to be in a situation where your position moves against you and you have to exit at a big loss. Even with frequent monitoring, there will be days when Alfred exits without a profit. Please trade cautiously and at your own risk.

Please note that the information provided is for educational purposes only. Options trading involves inherent risks, and all trading decisions should be made with careful consideration of your financial situation and risk tolerance. Trade at your own risk, and it is strongly recommended to consult with a qualified financial advisor or professional before engaging in any options trading activities.

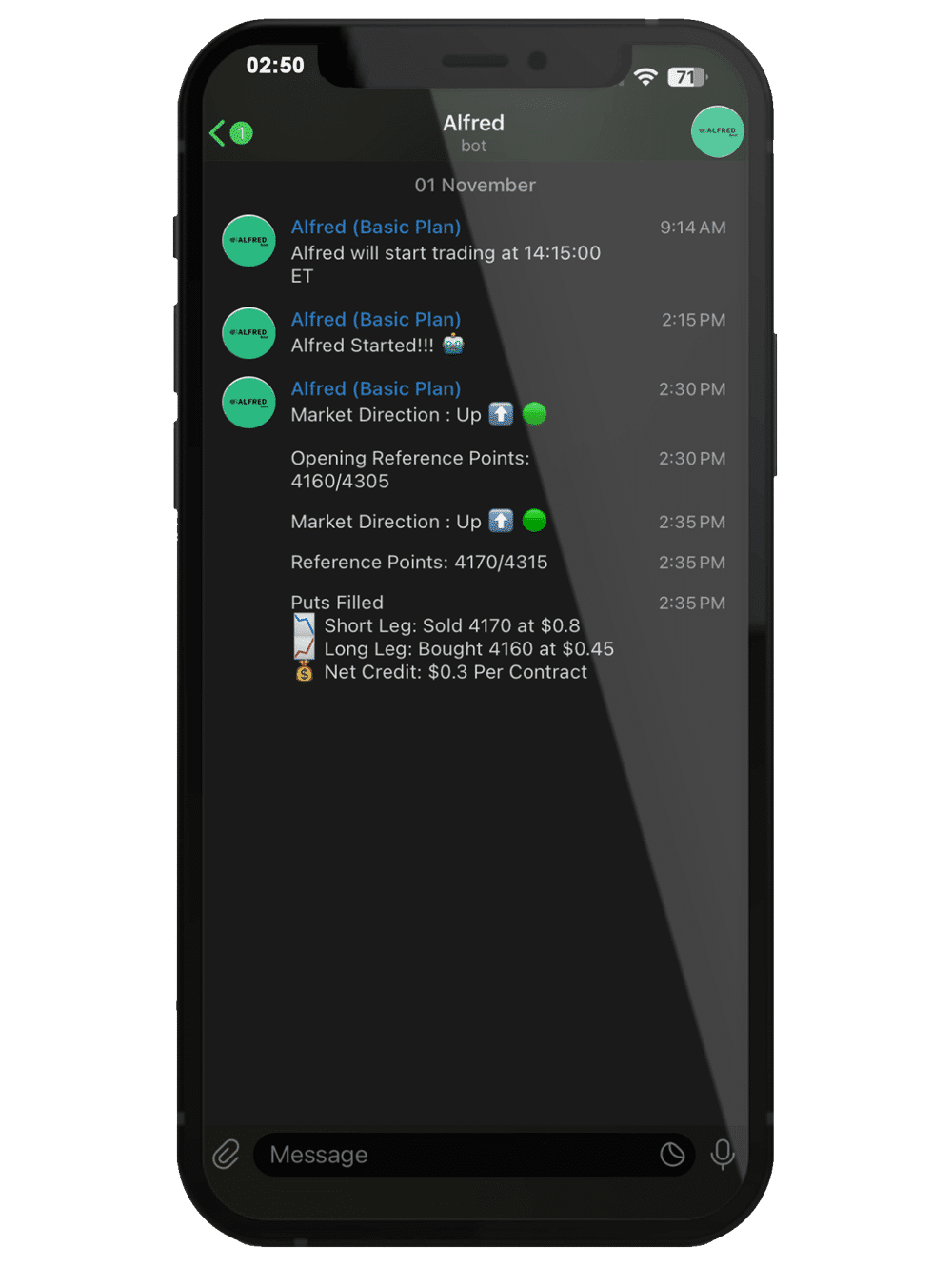

Alfred Basic:

At 9:15 Alfred will start running. If Alfred decides to trade later in the day, a message will go out at 9:14 stating such.

At 9:30 (or whatever start time is determined) Alfred will start analyzing the current market and send out a notification on the market direction and its initial reference points for puts and calls

At 9:35 (or 5 minutes after start time) Alfred will re-determine the market direction and reference points. At this time, Alfred will begin to execute a trade based on this criteria. Once a trade is filled, Alfred will notify you of the short and long leg of the position and the net credit for the trade.

Since we design most of these trades to expire worthless at 4:00, there is no exit notification. For times when the market goes against our trade, a warning and possible exit notification will be sent out (for Premium members only).

Alfred Premium:

All the notifications of Alfred Basic plus a Warning Level graph at 9:15 (or whatever start time is determined). The warning levels go from low-medium-high-critical. This will help gauge the current volatility of the market.

The rest of the notifications are the same as the Basic Plan.

As a Premium member, you will also receive exit notifications, should they become necessary.

The exit notifications will start with a warning stating the exit strategy has been activated. At this time, we remain in the position as Alfred analyzes the market on a 1 second interval. (Keep in mind, everyone’s risk tolerance is different and you can exit at any time. Even before any warnings are given, if you see fit or will no longer be able to monitor the trade.) During Alfred’s constant analysis, it will issue 3 warnings if certain criteria are met. The reason for 3 warnings is because sometimes there is a change in the market, but then it reverses making our trade profitable again. This helps us from exiting trades too soon. Upon the 3rd warning, Alfred will exit the trade and send out that notification. Occasionally, the market will move so fast, that 3 warnings will not be triggered. In this instance, Alfred will exit immediately and send out that notification.

Selling a Put Vertical Spread

Select Strike Prices

You begin by selecting two put options with different strike prices. The lower strike is the "long put," and the higher strike is the "short put."

Sell the Short Put

You sell the short put option, obligating you to buy the stock at the strike price if the stock's price falls below that level by expiration.

Buy the Long Put

Simultaneously, you buy the long put option at the lower strike price. This limits your potential losses as it gives you the right to sell the stock at this strike price if the stock price declines significantly.

Net Credit

You receive a credit upfront when selling the vertical put spread, which is the maximum profit you can achieve with this strategy.

Success of Selling a Put Vertical Spread

Selling a Call Vertical Spread

Select Strike Prices

Choose two call options with different strike prices. The lower strike is the "short call," and the higher strike is the "long call."

Sell the Short Call

You sell the short call option, obligating you to sell the stock at the strike price if the stock's price rises above that level by expiration.

Buy the Long Call

Simultaneously, you buy the long call option at the higher strike price, limiting your potential losses as it gives you the right to buy the stock at this strike price if the stock price rises significantly.

Net Credit

You receive a credit upfront when selling the short call, which is your maximum profit potential.

Success of Selling a Call Vertical Spread

Failure of Selling a Put or Call Vertical Spread

If the stock price surges significantly below the short put or above the short call, you could face losses, limited by the long put or call option. Transaction costs and bid-ask spread can reduce your profits.

Alfred's Strategy

CONCLUSION